What is a Digital Currency?

A digital currency refers to a form of currency that exists only in electronic or digital form. It is a virtual medium of exchange that utilizes cryptography to secure transactions and control the creation of new units. In simple terms, it’s like money that you can’t physically touch, but you can use it to buy goods and services online.

The concept of digital currency has gained immense popularity in recent years, with the rise of various cryptocurrencies like Bitcoin, Ethereum, and Litecoin. Unlike traditional currencies, which are issued and regulated by central banks, digital currencies operate in a decentralized manner. This means that no single entity or government has complete control over them. Transactions are recorded on a public ledger called the blockchain, which ensures transparency and security. As more people embrace digital currencies, their potential impact on the global economy continues to grow.

The History of Digital Currencies

Digital currencies have a long and winding history that can be traced back to the early days of the internet. It all began in the late 1990s when computer enthusiasts started experimenting with the idea of creating a decentralized digital currency. One of the earliest attempts was the creation of e-gold, which allowed users to store their wealth in a digital form. However, this digital currency was eventually shut down due to regulatory concerns and allegations of money laundering.

In 2009, a mysterious figure known as Satoshi Nakamoto changed the game by introducing Bitcoin, the first decentralized digital currency. Bitcoin gained popularity as it promised to eliminate the need for intermediaries like banks and provide a secure and anonymous way to conduct online transactions. Since then, numerous other digital currencies, commonly referred to as cryptocurrencies, have emerged, each with its own unique features and potential. From the humble beginnings of e-gold to the rise of Bitcoin, the history of digital currencies is filled with innovation and excitement.

How Does Cryptocurrency Work?

Cryptocurrency, like Bitcoin, works on a decentralized network called blockchain. This fancy word may sound intimidating, but it’s basically a digital ledger that keeps track of all the transactions. Picture it like a virtual bankbook where every transaction is recorded, verified, and added to a chain of previous transactions. This chain is visible to everyone in the network, ensuring transparency and security.

Now, let’s get into the nitty-gritty of how it works. When you want to send or receive cryptocurrency, you use your digital wallet. It’s like your own personal cyber purse. Inside this wallet, you have a pair of cryptographic keys – one public and one private. The public key is like your bank account number, which you share with others to receive funds. The private key, on the other hand, is like the secret PIN code to your bank account. It’s crucial to keep it safe and not share it with anyone. When you want to make a transaction, you sign it using your private key, and the network verifies it using your public key. Once it’s approved, the transaction is added to the blockchain for everyone in the network to see. It’s like a digital handshake, making sure everything is secure and nobody can mess with the records. So, that’s the basic mechanism behind how cryptocurrency works – it’s all about trusted transactions on a public ledger. Exciting stuff, right?

The Role of Blockchain Technology

Blockchain technology plays a pivotal role in the world of cryptocurrencies. You might even call it the secret sauce that makes cryptocurrencies possible. So, what exactly is blockchain? Well, imagine a virtual ledger that keeps track of all the transactions made within a network. It’s like a digital version of a traditional paper trail, but without a central authority verifying and recording every transaction. Instead, each transaction is verified and added to a block, and these blocks are then linked together in a chain, hence the name, blockchain. This decentralized nature of blockchain technology ensures transparency, immutability, and security, making it a key component in the world of cryptocurrencies.

The beauty of blockchain technology lies in its ability to eliminate the need for intermediaries. With traditional financial transactions, such as sending money internationally, you often rely on banks, payment processors, and other middlemen to facilitate the process. This can be time-consuming, costly, and prone to errors. However, with blockchain technology, transactions can be carried out directly between users, cutting out these intermediaries. This not only speeds up the process but also reduces fees and the risk of fraud. It’s like having a global ledger that everyone can access and contribute to without the need for a middleman.

The Difference Between Cryptocurrencies and Traditional Currencies

Cryptocurrencies have been gaining popularity in recent years, but how do they differ from traditional currencies? One key distinction is that traditional currencies, such as the US dollar or the Euro, are backed by central banks and governments. These institutions regulate the supply of money and ensure its stability. On the other hand, cryptocurrencies like Bitcoin or Ethereum are decentralized and operate independently of any central authority. Instead, they rely on complex algorithms and cryptography to secure transactions and control the creation of new coins.

Another difference lies in the way transactions are processed. Traditional currencies involve intermediaries such as banks or payment processors who facilitate transactions between parties. These intermediaries are responsible for verifying identities, ensuring compliance with regulations, and handling chargebacks if necessary. In contrast, cryptocurrencies use a technology called blockchain, which allows for direct peer-to-peer transactions without the need for intermediaries. Transactions are recorded on a public ledger, accessible to anyone, ensuring transparency and reducing the risk of fraud.

How to Buy and Sell Cryptocurrencies

If you’re interested in getting your hands on some cryptocurrencies, the first thing you’ll need to do is find a reliable and trustworthy platform to buy them from. There are plenty of options out there, but it’s important to do your research and choose a platform that fits your needs. Once you’ve found the right platform, the process is pretty straightforward. You’ll usually need to create an account and provide some basic personal information. After that, you can deposit funds into your account and start buying cryptocurrencies.

When it comes to selling cryptocurrencies, the process is just as easy. Most platforms have a simple interface that allows you to sell your coins with just a few clicks. Just like when buying, you’ll usually need to select the cryptocurrency you want to sell, specify the quantity, and choose the payment method you prefer. Keep in mind that the selling process may vary slightly depending on the platform you’re using, but in general, it’s a quick and straightforward process. Just make sure you’re aware of any fees that may be associated with selling your coins, as these can vary between platforms.

Understanding Wallets and Exchanges

If you want to dive into the world of cryptocurrencies, understanding wallets and exchanges is essential. Think of your wallet as a digital piggy bank for your digital coins. It’s where you store, send, and receive your crypto. But let me clarify something, these wallets don’t hold actual coins like the ones you’d find in your pocket – they hold records of transactions on the blockchain. Cool, right? It’s like having a virtual vault for your digital riches.

Now, let’s talk exchanges. These are like digital marketplaces where you can buy, sell, and trade different cryptocurrencies. It’s like going to a crowded bazaar, except you’re in your PJs and trading virtual coins instead of bartering for exotic spices. With so many exchanges out there, it’s important to choose a reliable and secure one. After all, you wouldn’t want to end up with a snake oil salesman who promises you the moon, only to vanish into the digital abyss with your hard-earned coins. So, do your research, read reviews, and choose wisely before you jump into the exciting world of crypto trading.

The Importance of Security in Cryptocurrency Transactions

When it comes to cryptocurrency transactions, security is of utmost importance. With the ever-increasing prevalence of cyber threats and hacking attempts, ensuring the safety of your digital assets has become a top priority. Whether you are buying, selling, or simply holding onto cryptocurrencies, taking the necessary precautions is crucial to keeping your investments secure.

One key aspect of securing cryptocurrency transactions is using a reliable and reputable wallet. A wallet acts as a digital vault where you can store your cryptocurrencies. It provides you with a unique address, or a series of numbers and letters, which serves as your personal identifier in the cryptocurrency world. It is essential to choose a trusted wallet provider that offers robust security features, such as two-factor authentication and encryption, to protect your funds from unauthorized access. By using a secure wallet, you can significantly reduce the risk of theft or loss of your digital assets.

Exploring Different Types of Cryptocurrencies

When it comes to exploring different types of cryptocurrencies, there’s a wide range to choose from. From the well-known Bitcoin to the up-and-coming Ethereum, each digital currency has its own unique features and benefits. But one thing they all have in common is their decentralized nature, which means they operate outside the control of traditional financial institutions. It’s like a wild west of currency, where the rules are different, and the possibilities seem endless.

One popular type of cryptocurrency is Litecoin. Created by Charlie Lee, a former Google engineer, Litecoin aims to be the silver to Bitcoin’s gold. It boasts faster transaction times and a different mining algorithm, making it an attractive option for those who want a quick and efficient digital currency. Then there’s Ripple, a digital currency specifically designed for financial institutions. Its goal is to facilitate fast and low-cost international money transfers, making it a potential game-changer for the banking industry. And let’s not forget about Dogecoin, the cryptocurrency that started as a joke but has gained a cult following. It features the beloved Shiba Inu dog as its mascot and has gained popularity for its active and fun community. So, whether you’re looking for speed, compatibility with the banking world, or just a good laugh, there’s a cryptocurrency out there for you.

The Risks and Benefits of Investing in Cryptocurrencies

Investing in cryptocurrencies can be a rollercoaster ride, with both risks and benefits to consider. On the one hand, investing in cryptocurrencies can offer significant potential for high returns. Many early investors have seen their initial investments grow exponentially, making them millionaires. This has attracted a wave of new investors eager to jump on the crypto bandwagon and reap similar rewards.

However, it’s crucial to remember that investing in cryptocurrencies is not for the faint-hearted. The market is highly volatile, with prices that can fluctuate wildly within a matter of hours. This volatility means that your investment could skyrocket one day and crash the next. So, if you’re someone who panics at the slightest sign of instability, investing in cryptocurrencies may not be the best choice for you. On the flip side, if you can handle the ups and downs and are willing to embrace the risk, there is a chance for substantial financial gains.

The Future of Cryptocurrencies

As we gaze into the crystal ball to catch a glimpse of the future of cryptocurrencies, it’s clear that we’re just scratching the surface of what’s to come. The world of digital money is evolving at breakneck speed, and it’s hard to predict where it will lead next. But one thing’s for certain – cryptocurrencies are here to stay.

With more and more companies accepting cryptocurrencies as a form of payment, it’s becoming increasingly evident that these digital assets are gaining mainstream acceptance. From major retailers to online platforms, the possibilities are endless. And as technology continues to advance, the convenience and security of cryptocurrencies will only improve. No longer will we be bound by physical money or the limitations of traditional banking systems. Instead, we’ll have the freedom to transact effortlessly and securely in the digital realm.

But with great power comes great responsibility. As the future unfolds, it’s crucial that we address the challenges and risks associated with cryptocurrencies. From regulatory hurdles to potential market volatility, there are still a multitude of obstacles to overcome. However, if we navigate this uncharted territory with caution and adaptability, the future of cryptocurrencies holds immense potential for reshaping the financial landscape as we know it. So fasten your seatbelts, folks – we’re in for a wild ride!

The Impact of Cryptocurrencies on the Global Economy

One of the most significant impacts that cryptocurrencies have had on the global economy is their ability to facilitate faster and cheaper cross-border transactions. Traditional methods of sending money internationally, such as wire transfers, can take several days and incur high fees. With cryptocurrencies, transactions can be completed in a matter of minutes, and the fees are often significantly lower. This has made it easier for businesses to expand globally and has opened up new opportunities for individuals to engage in international trade.

Another way that cryptocurrencies have influenced the global economy is by providing a means for individuals in countries with unstable or restrictive financial systems to store their wealth. In many countries, hyperinflation or government intervention can erode the value of traditional fiat currencies. Cryptocurrencies offer an alternative store of value that is not subject to the same risks. This has allowed individuals in these countries to protect their savings and maintain their purchasing power, even in the face of economic instability. Furthermore, cryptocurrencies have also given people in economically marginalized communities access to financial services that were previously out of reach, allowing them to participate more fully in the global economy.

How Governments and Financial Institutions View Cryptocurrencies

As cryptocurrencies continue to gain popularity, governments and financial institutions around the world are taking notice and forming their own opinions on this digital phenomenon. Some see cryptocurrencies as a disruptive force that challenges traditional financial systems, while others view them as a potential opportunity for innovation and growth.

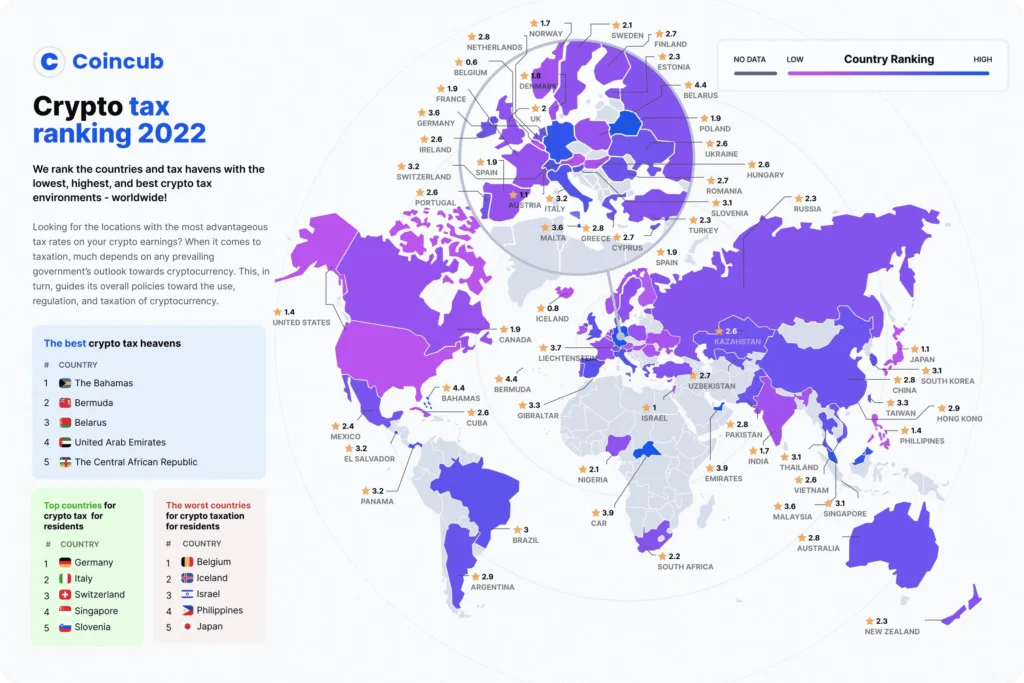

Many governments are grappling with the regulatory implications of cryptocurrencies. Some have embraced them as a way to foster technological innovation and attract investment, while others have expressed concerns about the potential for money laundering, fraud, and market instability. Financial institutions, on the other hand, often approach cryptocurrencies with caution, as they navigate the risks associated with this new and rapidly evolving sector.

Overall, the views of governments and financial institutions on cryptocurrencies are diverse and evolving. As the technology continues to develop and mature, it is likely that we will see more clarity and regulation in the space. Until then, it is important for individuals and businesses to stay informed and navigate the cryptocurrency market with caution. After all, in this digital world, understanding the views and actions of governments and financial institutions can have a significant impact on the future of cryptocurrencies.

Common Misconceptions About Cryptocurrencies

One common misconception about cryptocurrencies is that they are only used for illegal activities. While it is true that cryptocurrencies provide a level of anonymity, this doesn’t mean that they are exclusively used for illicit purposes. In fact, many legitimate businesses and individuals use cryptocurrencies for various transactions and investments. It’s important to understand that like any other form of currency, cryptocurrencies can be used for both legal and illegal activities. So, instead of assuming the worst, it’s crucial to recognize the wide range of uses and applications for cryptocurrencies in today’s digital world.

Another misconception is that cryptocurrencies are completely unregulated and not backed by any government or institution. While it is true that cryptocurrencies operate outside the traditional banking system, this doesn’t mean that they exist in a regulatory vacuum. Many countries have implemented regulations and laws to govern the use and trading of cryptocurrencies. Additionally, there are organizations and industry bodies that oversee and set standards for cryptocurrencies. It’s important to research and understand the regulatory landscape in your jurisdiction before engaging in any cryptocurrency-related activities. By doing so, you can ensure that you are operating within the legal framework while exploring the potential of this innovative digital asset.

Tips for Successfully Navigating the Cryptocurrency Market

Navigating the cryptocurrency market can be an exciting and potentially lucrative endeavor. However, it’s important to approach it with caution and a clear strategy. One tip for success is to do your research before diving in headfirst. Understanding the different types of cryptocurrencies, their histories, and their underlying technology is crucial. Additionally, keep an eye on the market trends and stay updated with the latest news and developments. This will help you make informed decisions and avoid unnecessary risks.

Another tip is to start small and gradually increase your investments as you gain experience and confidence. It’s easy to get caught up in the hype and invest a significant amount of money in a short period of time. However, this approach can be risky, especially if you’re new to the market. Start with a small amount of money that you’re comfortable with losing, and use it as a learning experience. As you become more knowledgeable and familiar with the market dynamics, you can gradually increase your investments. Remember, slow and steady wins the race, and patience is key when it comes to navigating the cryptocurrency market.