How Does the IRS View Cryptocurrency?

The IRS is keeping a close eye on the world of cryptocurrency. While the concept of virtual currency may seem foreign to many, the tax implications are very real. According to the IRS, cryptocurrency is treated as property for tax purposes, which means that any transactions involving digital currencies could potentially be subject to taxable events.

When it comes to reporting cryptocurrency income, the IRS expects individuals to be transparent. They require taxpayers to report all income, including any gains or losses from cryptocurrency transactions. This means that if you’ve made money from buying or selling virtual currencies, or if you’ve received cryptocurrency as payment for goods or services, it’s important to keep meticulous records and report it on your tax return.

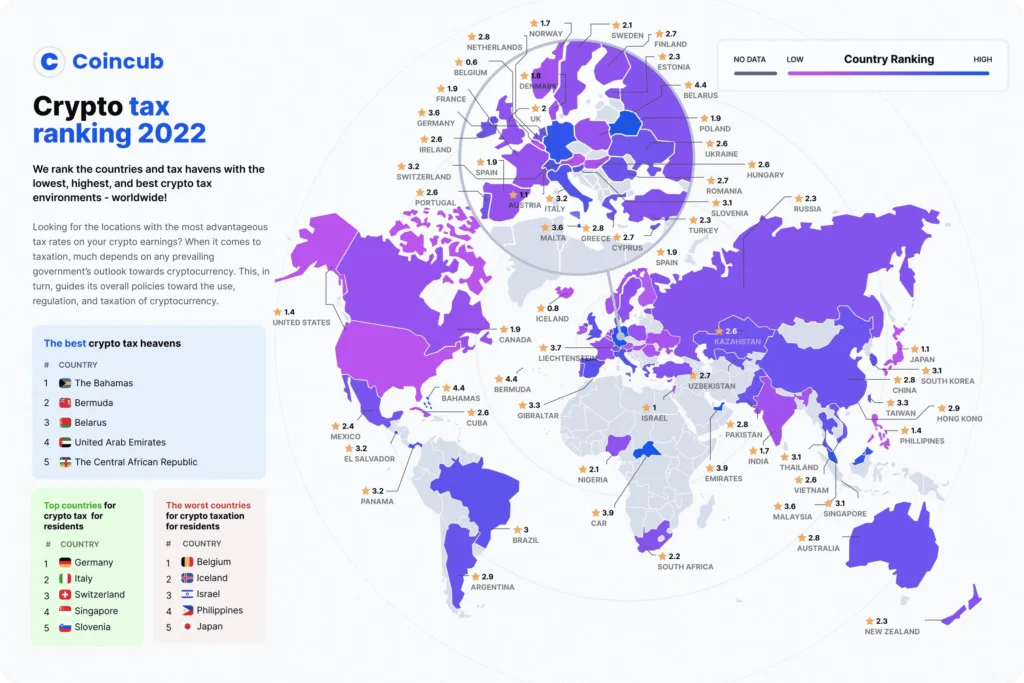

Navigating the IRS guidelines on cryptocurrency can be challenging, but it’s essential to stay compliant to avoid any issues down the line. As the popularity of digital currencies continues to grow, it’s likely that the IRS will continue to refine their stance on how they view and tax cryptocurrency. Keeping abreast of any changes to the tax code and seeking professional tax advice can help ensure that you stay on the right side of the law when it comes to reporting your cryptocurrency activities.

Determining Your Taxable Events in the Cryptocurrency World

Determining your taxable events in the cryptocurrency world can be a tricky task, but it’s crucial to understand what transactions are considered taxable. When it comes to cryptocurrency, taxable events can occur when you sell or exchange your digital currencies for fiat currencies like the US dollar. The IRS views these transactions as similar to selling stocks or other investments, meaning that any gains or losses you incur may be subject to taxes. So, if you’ve cashed out your bitcoin and made a profit, don’t forget to set aside some funds for potential tax obligations.

In addition to selling or exchanging your cryptocurrencies, other transactions can also be considered taxable events. For instance, if you use your digital currencies to purchase goods or services, the fair market value of the cryptocurrency at the time of the transaction is typically used to determine any taxable gains. Similarly, receiving cryptocurrencies as payment for your work or services is also considered taxable income. It’s important to keep track of every transaction and accurately report them to ensure compliance with tax regulations. So, whether you’re buying or selling, trading or using your digital currencies, be aware of the potential tax implications so that you can navigate the cryptocurrency world responsibly.

Reporting Cryptocurrency Income: What You Need to Know

When it comes to reporting cryptocurrency income, there are a few key things you need to know. First and foremost, it’s important to understand that the IRS views virtual currencies like Bitcoin as property rather than traditional currency. This means that any income you generate from buying, selling, or exchanging cryptocurrencies is subject to tax.

So, how do you report this income? Well, it depends on the specific circumstances. If you receive cryptocurrency as payment for goods or services, it should be reported as ordinary income based on the fair market value at the time of receipt. On the other hand, if you sell or exchange your virtual currencies, you may need to report capital gains or losses. It’s crucial to keep detailed records of your transactions, including dates, amounts, and the fair market value at the time of each transaction. This will not only help you accurately report your income but also provide evidence in case the IRS decides to audit you.

Tracking Your Cryptocurrency Transactions: Best Practices

Tracking your cryptocurrency transactions is crucial when it comes to managing your financial affairs and staying on top of your tax obligations. As the cryptocurrency market continues to grow, it becomes increasingly important to adopt best practices for tracking your transactions.

One of the first things you should do is maintain a detailed record of every cryptocurrency transaction you make. This includes the date of the transaction, the type of cryptocurrency involved, the amount transacted, and the value of the cryptocurrency at the time of the transaction. Keeping a clear and accurate record will not only simplify your tax reporting but also help you monitor your gains, losses, and overall portfolio performance. Additionally, if you ever find yourself subject to an IRS audit, having a well-documented transaction history will provide the necessary evidence to support your tax position.

Are Cryptocurrency Losses Deductible?

Cryptocurrency investments can be a wild ride. Just like any other investment, the value can go up, but it can also go down. And when it comes to tax time, many wonder if they can at least get a break by deducting cryptocurrency losses. Fortunately, the answer is yes, but with a few caveats.

When it comes to deducting cryptocurrency losses, the IRS treats them similar to losses from other types of investments, such as stocks or real estate. If you sell your cryptocurrency at a loss, you may be able to deduct the loss on your tax return. However, it’s important to note that the IRS has specific rules and limitations when it comes to deducting investment losses. So, before you start deducting those losses, make sure you familiarize yourself with the guidelines and consult with a tax professional who can help you navigate through the process. After all, you don’t want to make any missteps that could potentially raise red flags with the IRS.

Navigating the Tax Treatment of Cryptocurrency Mining

Mining cryptocurrencies has become a popular way for individuals to participate in the digital currency market. However, it’s important to understand the tax implications that come with this activity. The IRS views cryptocurrency mining as a form of self-employment, which means that miners are subject to taxation on their mining income.

When it comes to determining how to report mining income, things can get a bit complex. One of the main considerations is whether you are mining as a hobby or as a business. If mining is simply a hobby for you, then any income generated from it is generally considered miscellaneous income and should be reported on Schedule 1 of your tax return. However, if you are mining as a business, you will need to report your income and expenses on Schedule C. It’s important to keep detailed records of your mining activities, including the cost of equipment, electricity, and any other expenses related to your mining operation.

As you navigate the tax treatment of cryptocurrency mining, it’s crucial to consult with a tax professional who specializes in this area. They can guide you through the complexities of reporting your mining income and ensure that you are complying with all IRS regulations. Additionally, they can help you identify any potential deductions or credits that may be available to you. By partnering with a knowledgeable tax advisor, you can confidently navigate the tax landscape of cryptocurrency mining and ensure that you are meeting your tax obligations.

Crypto-to-Crypto Transactions: Tax Considerations

Crypto-to-Crypto Transactions: Tax Considerations

Texters and traders, listen up! When it comes to crypto-to-crypto transactions, tax considerations can be a bit of a bumpy ride. The Internal Revenue Service (IRS) takes a stance and views these transactions as taxable events. Yep, you heard that right – that means Uncle Sam expects a piece of the pie when you trade one digital currency for another.

Now, before you start panicking and rummaging through your wallet, let’s dive into the details. Each time you make a crypto-to-crypto transaction, you need to determine the fair market value of both currencies involved. It’s like haggling at a flea market, except you’ll be calculating the value in good old US dollars instead of bartering for a dusty lamp. This fair market value serves as the basis for calculating any potential gains or losses that will come into play when you report your crypto activities to the IRS. So, buckle up and get ready to navigate the exciting and complex world of crypto-to-crypto transactions with tax considerations in mind!

Cryptocurrency and Self-Employment Taxes: What You Should Know

Cryptocurrency and self-employment taxes can be a complex combination that catches many people off guard. As a self-employed individual in the cryptocurrency world, it’s important to understand how these two elements intersect. Firstly, it’s crucial to determine if your cryptocurrency activities can be classified as self-employment. If you’re actively trading or providing services in exchange for digital currencies, the IRS may consider it as self-employment income. This means you could be subject to self-employment taxes, such as Social Security and Medicare taxes, on top of your regular income tax.

To stay on the right side of the IRS when it comes to self-employment taxes and cryptocurrency, it’s necessary to report your income accurately. Keep detailed records of all your transactions, including the value of each crypto asset received or earned. Remember, the value of cryptocurrencies can fluctuate greatly, so it’s essential to document the fair market value at the time of each transaction. By maintaining precise records and employing best practices in tracking your cryptocurrency earnings, you can ensure that you’re well-prepared to report your income and comply with self-employment tax obligations. Understanding the intricacies of self-employment taxes in relation to cryptocurrency can save you from potential tax troubles in the future.