The Fascinating World of Digital Currencies

The whole world is buzzing about digital currencies, and for good reason. These virtual coins have taken the financial industry by storm, challenging the traditional notion of money. What makes them so intriguing is their decentralized nature, which means they are not controlled by any government or central authority. It’s like a free-for-all where anyone can participate and be part of this new monetary revolution.

But what exactly are digital currencies? Well, they are a form of online money that exists solely in the digital realm. Think of them as digital tokens that can be used to buy goods and services, just like traditional money. The difference is that these currencies are not physical, you can’t touch or hold them in your hand. Instead, they exist as strings of code, stored in digital wallets that are accessed through computers or smartphones. It might sound strange at first, but as you delve deeper into this fascinating world, you’ll realize that it’s a whole new way of thinking about money.

Understanding the Evolution of Virtual Money

Virtual money has come a long way since its inception. It all started with a simple idea: to create a form of currency that exists solely in the digital realm. And boy, did it take off! With the advancement of technology, digital currencies like Bitcoin, Ethereum, and Ripple have become a force to be reckoned with in the financial world.

We’ve seen virtual money go from being a novelty to a mainstream phenomenon. People are now using it for everyday transactions, from buying groceries to booking vacations. The convenience and security it offers have certainly captured the attention of the masses. But it’s not just about convenience; digital currencies have also revolutionized the way we think about money. No longer do we need to rely on traditional banks and their hefty fees. With virtual money, we can be our own bank, in control of our finances with just a few taps on our smartphones. It’s a brave new world, indeed!

Exploring the Boom in Digital Assets

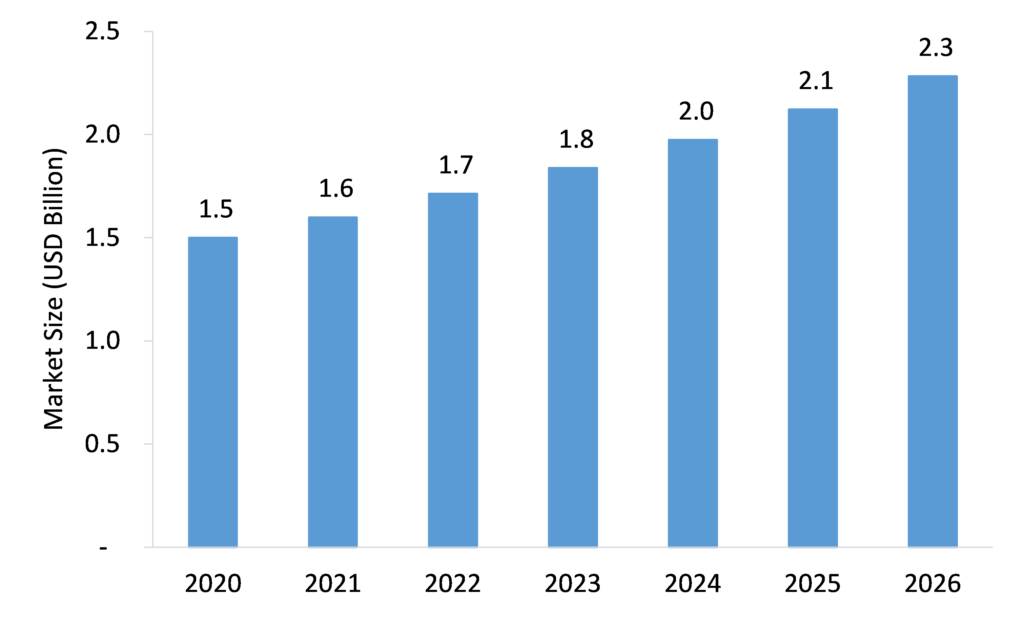

In today’s fast-paced world, the boom in digital assets has taken the financial market by storm. With the rise of cryptocurrencies such as Bitcoin and Ethereum, more and more investors are exploring the exciting opportunities that digital assets present. It’s like a rollercoaster ride, where you can witness dramatic price swings within a matter of minutes. One minute, you may be flying high on the gains you’ve made, and the next, you’re on a wild downhill plunge, hoping to hold on tight until the market stabilizes.

Digital assets have not only captivated the attention of seasoned investors but also attracted a whole new breed of traders. The convenience of buying and selling digital currencies online has made them accessible to anyone with an internet connection and a desire to ride the wave of this financial revolution. People from all walks of life are jumping on the bandwagon, hoping to strike gold in this digital gold rush. But amidst the hype and excitement, it’s crucial to approach this market with caution and an understanding that the landscape of digital assets is ever-changing, with risks and rewards lurking around every corner.

The Rise of Bitcoin and its Impact on the Market

Bitcoin, the decentralized digital currency, has taken the world by storm. Its rise to prominence has had a significant impact on the global market, stirring up conversations and debates among experts and amateurs alike. With its unique characteristics, bitcoin has disrupted traditional financial systems and challenged conventional notions of money.

As bitcoin gained popularity, it attracted both enthusiasts and skeptics. The cryptocurrency’s decentralized nature, allowing individuals to transact directly without intermediaries, has been a game-changer. This peer-to-peer system offers users more control over their finances and eliminates the need for costly third-party services. However, this freedom has also raised concerns about security and regulation. While some embrace bitcoin as the future of currency, others worry about its potential for illegal activities and market volatility. Nonetheless, there is no denying that bitcoin’s impact on the market has ignited a new era in finance, with governments and financial institutions closely monitoring its developments.

Unveiling the Different Types of Cryptocurrencies

Cryptocurrencies have taken the world by storm, offering individuals a new and exciting way to participate in the digital financial landscape. With so many options to choose from, it’s important to understand the different types of cryptocurrencies available. Let’s dive in and unravel the mystery of these digital assets.

First up, we have the granddaddy of them all – Bitcoin. This pioneering cryptocurrency burst onto the scene in 2009 and quickly gained popularity. With its decentralized nature and limited supply, Bitcoin has become synonymous with digital currencies. Investors see it as a store of value and a potential hedge against traditional financial systems. However, don’t let Bitcoin steal the spotlight entirely, as there are numerous other cryptocurrencies fighting for recognition in the market.

How Blockchain Technology Revolutionized the Financial Industry

Blockchain technology has completely transformed the financial industry, shaking it to its core. It has revolutionized the way transactions are conducted, making them more secure, efficient, and transparent. With blockchain, financial institutions no longer need to rely on intermediaries like banks to oversee transactions. Instead, they can rely on the decentralized and distributed ledger system provided by blockchain.

One of the most significant ways blockchain has revolutionized the financial industry is through the creation of smart contracts. These contracts are self-executing and enforceable agreements that streamline business operations. With the use of blockchain, parties involved in a transaction can trust that the terms of the contract will be executed automatically, without the need for intermediaries. This not only saves time and reduces costs but also eliminates the potential for fraud or human error. Blockchain has truly changed the game by providing a secure and efficient platform for financial transactions.

The Pros and Cons of Investing in Digital Coins

Pros:

Investing in digital coins offers numerous advantages for individuals looking to diversify their portfolios. One major perk is the potential for high returns. With the volatility of digital currencies, there is a chance of making significant profits within a short period. However, it’s important to note that these gains come with substantial risks, as the market can be quite unpredictable. So, those looking to invest in digital coins should be prepared for a rollercoaster ride.

Another advantage of investing in digital coins is the opportunity to participate in the innovative world of blockchain technology. This cutting-edge technology has the potential to revolutionize various industries, from finance to supply chain management. By investing in digital coins, individuals can support these advancements and potentially reap the benefits of being early adopters. Additionally, the decentralized nature of cryptocurrencies offers individuals greater control over their financial transactions, providing privacy and security that traditional financial systems may lack.

Analyzing the Factors Influencing Cryptocurrency Prices

Cryptocurrency prices can be influenced by a myriad of factors, both internal and external. One of the key factors that can impact prices is market demand. Just like any other commodity, the law of supply and demand plays a vital role in determining the value of digital currencies. When the demand for a particular cryptocurrency outweighs the supply, its price tends to rise. On the flip side, if the supply surpasses the demand, prices may experience a decline.

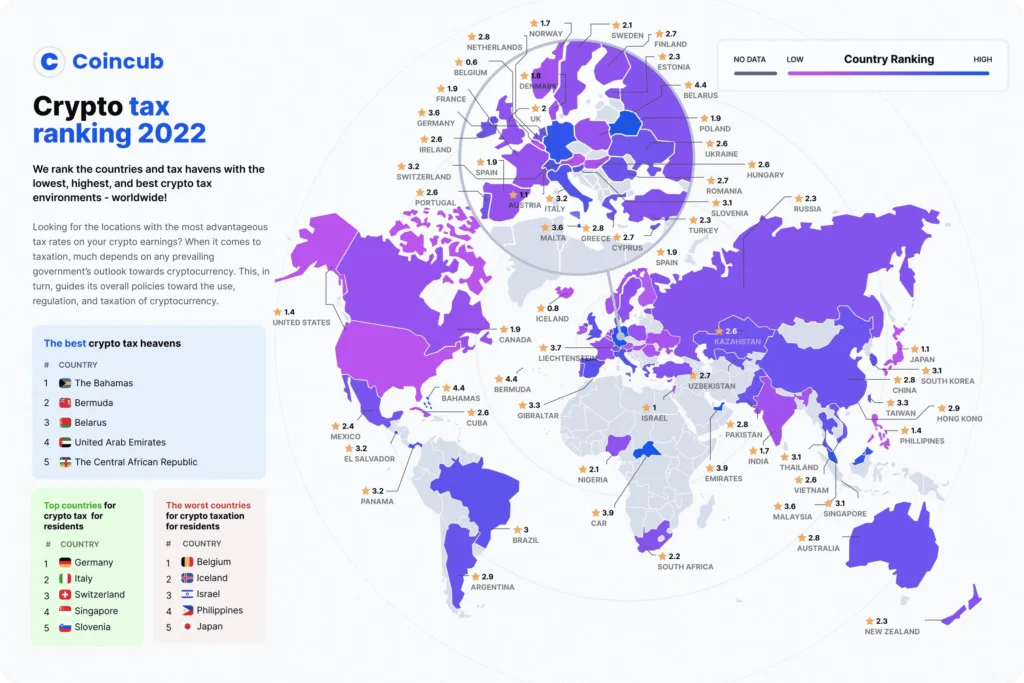

Another factor that can have a profound impact on cryptocurrency prices is regulatory changes. The regulatory environment surrounding digital assets varies from country to country, and any updates or announcements in regulations can cause significant price fluctuations. For instance, if a government announces favorable regulations, it can boost investor confidence and attract more buyers, leading to an increase in prices. Conversely, stricter regulations or bans can have the opposite effect, causing prices to plummet.

In addition to market demand and regulatory changes, other factors such as technological advancements, media coverage, investor sentiment, and macroeconomic indicators also influence cryptocurrency prices. Understanding the interplay between these various factors is crucial for investors and enthusiasts alike, as it can help in making informed decisions and navigating the volatile world of digital currencies. So, whether you are planning to invest or simply curious about the dynamics behind cryptocurrency prices, studying these factors can provide valuable insights into this fascinating realm.